Introducing document-free ID verifications with connected bank accounts

Our new feature takes photo ID a big step closer to day-to-day redundancy.

A big part of our mission is to make basic financial services much more inclusive. A new feature we’re announcing today puts us further ahead of the curve.

We’re already the first Know Your Customer (KYC) platform to support trusted verification through a referee — friend, family member, or anyone the user knows — filling the gaps where photo ID or reliable data may not be available.

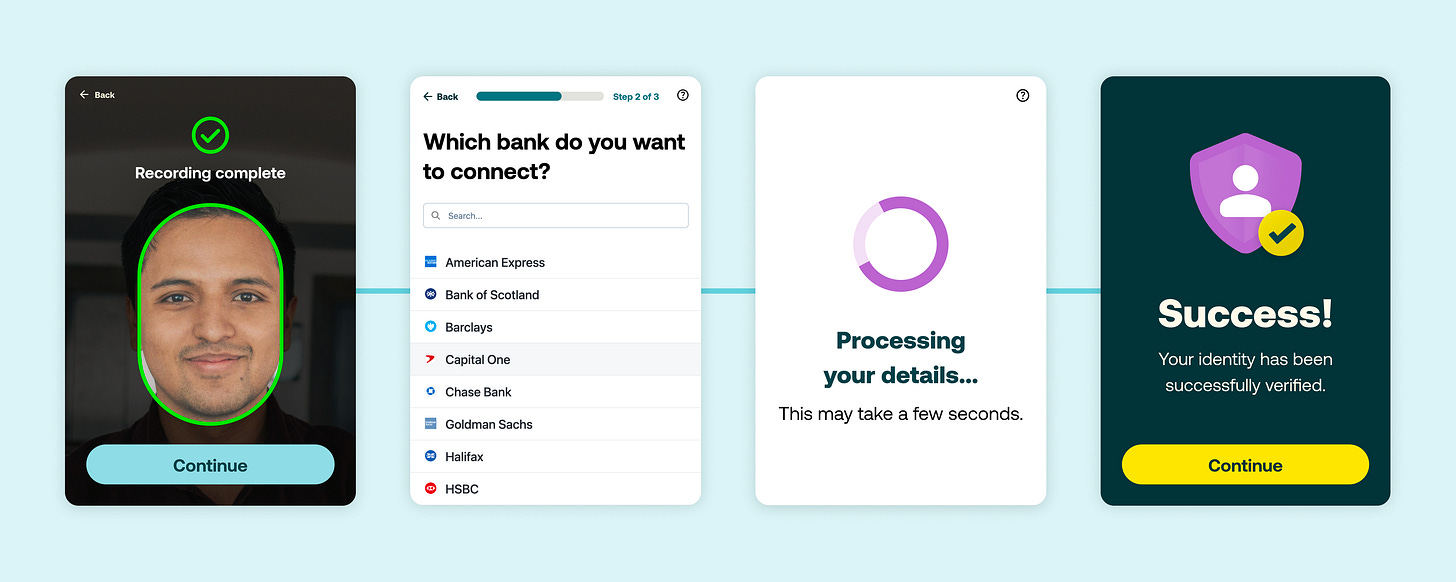

Today, we’re doubling down by introducing document-free identity verification through a connected bank account.

Banks are held to strict anti-money laundering standards, but provide APIs so that the data they hold can be shared with the account holder’s permission.

Most UK and EU banks are supported, and any current or savings account held by a single named individual can be accepted. So no joint or business accounts.

Vouchsafe takes the information we gain from the bank and combines it with a video selfie, so you can still be sure you’re dealing with a real person.

We then run our anti-fraud checks, so that you can get a complete picture of the user’s digital footprint.

It’s an excellent way to speed up verification, and avoid awkward document scans. It’s compliant in the UK.

This is a vital step to help people without basic forms of ID. But it’s also perfect for people who can’t remember whether their passport is buried in a drawer with allen keys or stuffed down the back of the wardrobe.

Speak to us if you’re interested in bolstering your KYC with bank account verification: hello@vouchsafe.id

Vouchsafe news

➡️ I’ll be speaking at MALG Conference 2024. Come along to hear about how to provide KYC that customers don’t hate. Aspire Leeds on 7 November is the place to be.

➡️ We’ll also be going along to Slush in Helsinki on 20 and 21 November. This is a great event to hear about exciting things in tech in general. Say hi if you’re there!

➡️ October is ADHD Awareness Month and Chloe is on the case. Follow Chloe on LinkedIn for updates on this topic, and how we support neurodiversity at Vouchsafe more generally.

➡️ This week we made it into Focal’s Top 100 worldwide startups out of 2,100 applicants. That puts us firmly in the top 5%!

➡️ … which follows swiftly off the back of making it into the startup category shortlist of Santander’s UK X Awards recognising disruptive startups. On Tuesday we made our pitch for the finals this November. Cross your fingers for us.

➡️ A couple of weeks ago, we presented Vouchsafe at NTT Finnovation UK 2024 awards. Nkechi presented brilliantly, and though we didn’t win, we came a close second. Thanks very much if you came along and said hello — there, or at IdentityDay, for that matter!

➡️ And finally, a member of the Vouchsafe team who wishes to remain anonymous managed to guess their way through some Knowledge-Based Verification questions with a leading credit score checking service. It’s unclear whether this was improbably lucky or because the service just didn’t care that much about the answers.

Links of note

🔗 Starling fined £29m by UK regulator (LinkedIn News) — “High-risk customers were able to open 54,000 accounts between September 2021 and November 2022.” The best argument for good KYC is bad KYC, and there are no end of examples.

🔗 FICO Survey: UK Banks Face Consumer Frustration Over Customer Identity Management (PR Newswire) – “only 29 percent of document capture is integrated into the same [digital] channel, leaving clients much more likely to abandon an application, for example after being forced to download another app or scan and email documents.” If only there was a platform-agnostic way to make this easy — making it possible in a web browser, say. 😐

🔗 The Importance Of Post-Breach Digital Identity (Forbes) — A good article making the case for more robust identity verification in the face of growing data breaches. Verification by means of, say, Knowledge-Based Verfication is next to useless when the answers to your “secret” questions are in the public domain …

🔗 … To wit: One-third of the US population’s background info is now public (Cybernews) — 2.2TB of personal data belonging to US citizens was recently found to be exposed to the internet. When it comes to the exposure of any one piece of data, it’s becoming a question of when, not if.

🔗 Gartner Predicts At Least 500 Million Smartphone Users Will Be Using a Digital Identity Wallet by 2026 — A strong case for the need to move beyond traditional verification methods. It isn’t just about inclusion. It’s better UX for everyone.

Thanks for reading. Don’t have nightmares! 💛